Fintech is the greatest financial transformation of 21century. Fintech is the short form of financial technology which includes huge range of new generation product, service, technology and business model that are changing the financial services industry.

We will go through the basic of fintech in this article. Major area we cover here:

- Definition of fintech

- Basic understanding of Fintech

- Historical Background of Fintech

- Current Status Quo of Fintech

- What are the major tools of Fintech?

- What will be the shape of bank in future?

- Trust and security issues

Definition of Fintech:

Some define fintech as payment solution for bank. Some define fintech as fintech startup, even some define fintech as API development for bank and financial services. But we see fintech as ” The impact of technology on financial services”. Whether it is blockchain based cryptocurrency, NFT, or CBDC all are included in fintech.

Alternative definition of fintech:

Fintech is a set of technology that improve and automate the delivery channel of financial service. Fintech also deals with conventional banking to cryptocurrency, blockchain, CBDC, smart contract and many more.

Basic Understanding of fintech:

Though fintech is a buzzword in financial and banking area now a days, to make a common understanding of this topics you do not need to become a programmer or an Artificial intelligence expert. Fintech is not even a rocket science. Anyone from any industry can have basics understanding of fintech if he knows how technology change.

For developing basic understanding of fintech you must know how blockchain, artificial intelligence, web 3.0 cryptocurrency works. Definitely we will discuss all those issue step by step with this blog. Hope near future we will also make small but smart video to demonstrate those area. In next part we will tear down historical change of fintech.

Historical Background of Fintech:

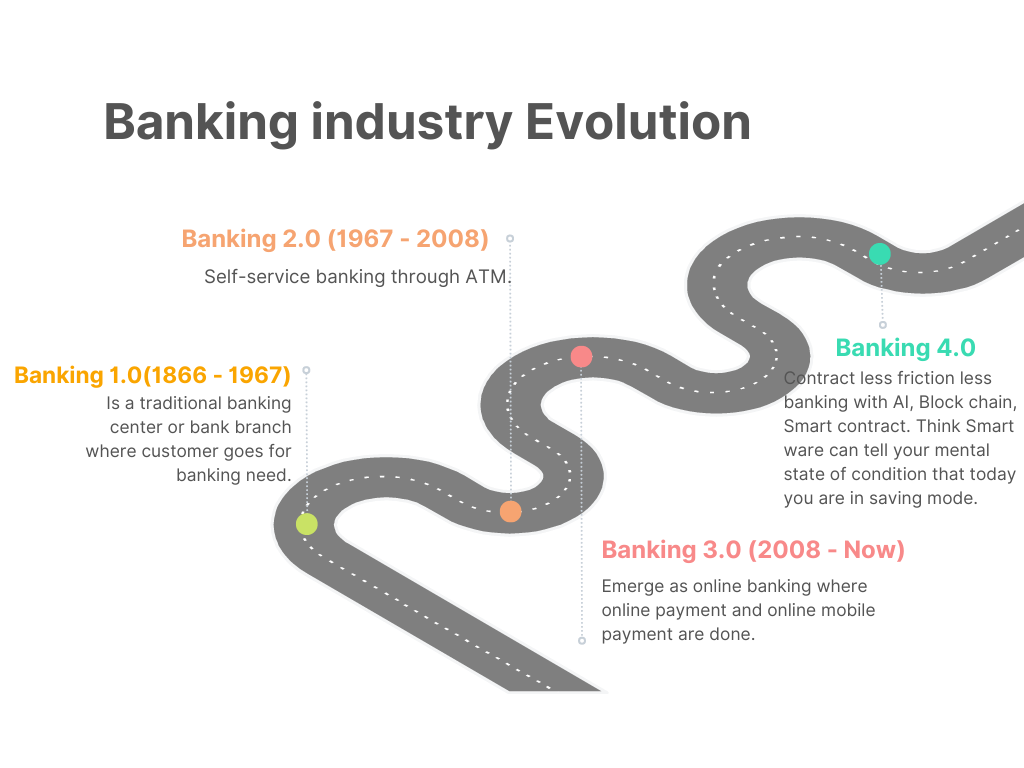

Historically Banks and financial institutions are the front liner to adopt any new technology for better services. The buzzword fintech is actually at least 70 years older, when it started with inception of credit card in 1950. Then it evolves over time from banking 1.0 to banking 4.0.

banking1.0: Is a traditional banking center or bank branch where customer goes for banking need.

Banking 2.0: Self-service banking through ATM.

Banking 3.0: Emerge as online banking where online payment and online mobile payment are done.

Banking 4.0: Contract less friction less banking with AI, Block chain, Smart contract. Think Smart ware can tell your mental state of condition that today you are in saving mode.

However during the economic turmoil of 2008 there are many significant advancement happened in fintech industry. In early 2000 all the new technology comes to our hand like iphone, whatsapp, uber, facebook and so on. But banking industry and financial sector are busy with imposing with new terms and restriction. Banking and financial industry had done very little or no innovation in that time. Whereas there is a huge gap create in tech firm and financial sector. which expedites to grow todays fintech industry.

Current status quo of fintech:

Fintech firms are flooded with huge investment over the past few years. In 2017 fintech firm got investment of $128 billion whereas in 2018 they got $254 billion which is almost 46% higher then previous year. The growth of fintech market can be estimated through its market value. The market value of fintech market was $128 billion in 2017 which will be $310 in 2022.

| Year | Total Investment |

| 2017 | $128 billion |

| 2018 | $254 billion |

| 2022 | $310 billion |

Who are the current players?

We will divide this section in four parts :

- Tech firms:

- Government bodies:

- Traditional Bank and financial firms:

- New startup:

- Tech firms work as fintech:

1. Facebook have 50+ license to transfer money with its users.

2. Amazon provides student loan.

3. Alipay is one of the biggest players of Chinese Money Market.

4. We chat is used for every households needs of china.

Government bodies:

Central bank of China, India, Jamaica, Japan, Russia already run CBDC. Central bank and regulatory authority of Canada, USA, Uk, Mexico are in research state for CBDC or digital currency.

Traditional Bank and financial firms:

In first quarter of 2022, 52 bank and financial institution make more than $60 billion in 37 fintech startup. Major banks are citi group, American Express, JP Morgan and SBI.

New startup for fintech:

New startup also keeps significant role in this fintech ecosystem. Clyde, Difit, Remitly, Spring Labs and many more got series A, B, C, D level funding.

What you think? When libra, Google pay and Apple pay come as a bank or financial institution?? Yes, they already exist in financial institution race. In few countries government and regulatory authorities impose restriction upon those fintech master player. But how long government and regulators make circuit breaker to them? Sonner or later Decentralize finance and fintech firms will take over traditional banking Ideas.

What are the major tools for fintech:

From artificial intelligence to blockchain all the newest technology are being used in fintech. Mobile payment system is the pioneer of fintech industry. Blockchain based cryptocurrency is a major example of fintech world. Even Elon musk invested in bitcoin. One bitcoin now a day tread near about $100000. Here we mention some major technology those are used in fintech industry.

1. blockchain

2. Artificial Intelligence

3. Crypto-currency

4. Robo advisor

5. Peer to peer landing

6. Machine Learning

7. Crowdfunding

8. Big data

9. Smart Contract

Though those may know or unknown to you we will make series of article to step down those issue in future.

What will shape of bank in future?

The future of banking will be very different from banking today. With more and more generation-z emerge as bank customer they will demand more and different things from bank. So bank needs new business model and new technology to coupe up with fintech race. Situation be like change and adopt technology or we will eat you up.

1. Invest more and more in Research and Development. To evolve new idea of fintech.

2. Let technology company be front end banking and traditional bank handle the backend banking.

3. Some days central banking became obsolete or Central Bank Digital Currency (CBDC) emerge.

Trust and security issues:

There is always a room for security issue in Virtual world. There is some solution also. So far blockchain based technology is believed to be most secure. But there is nothing 100% bullet proof here we have research and develop best for us. In terms of trusts we have 120% faith on whatsapp facebook. We even do not hesitate to share our private picture with those platforms. I think our next generation has more trust on fb and apple than standard chartered and others banks.

In fine about fintech:

There is a new wave of financial technology already started. Many of today’s financial sectors technology will be replace through fintech development. All the next generation financial sector development will be based on Blockchain, Cryptocurrency, Smart contract, Pear to pear lending and so on. We must keep eyes closer to adopt with those future of financial technology. We started our journey to learn about newest financial technology. What you think will many of today conventional bank exist in long race of fintech??